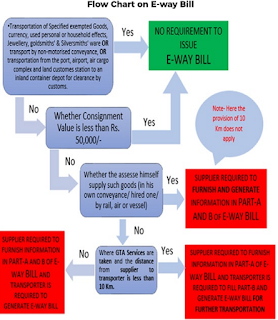

Cases when an Eway bill is not required

Cases when an Eway bill is not required The GST law was introduced in India to right the several wrongs that the erstwhile law had. One of the main problems was that there was lack of transparency in the process with respect to both, the taxpayers as well as the Government. Under the GST regime, one of the methods of the Government to ensure transparency is by digitizing the process. Eway bill is one such measure. 1. Documents to carry in case eway bill is not required An Eway bill will act as an effective tool to check on tax evasion at various points and to track the movement of goods. But when it is not required to be generated, the transporter has to ensure that a copy of tax invoice or a bill of supply prepared according to the provisions of Law is carried. An insight of how eway bill acts as a tax evasion tool can be seen from an instance. If some raw material is being transported from Karnataka to Tamil Nadu where it is processed into finished goods and sold, the state which