Due Dates in April-18

S No. | Event Date | Act | Application Form | Obligation |

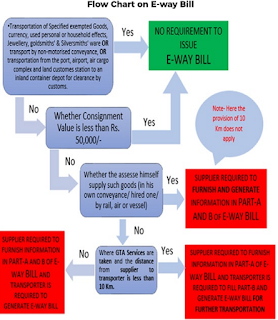

1 | 01st April 2018 | GST | EWB‐01 | E‐way Bill Mandatory for Inter‐state Supplies |

2 | 07th April 2018 | Income Tax | Form No. 27C (TCS) | Submission of Forms received in March ‐ 2018 to IT Commissioner |

3 | 12th April 2018 | GST | GSTR ‐ 1 | Taxpayers with annual aggregate turnover more than Rs. 1.5 crore need to file GSTR 1 for Feb on Monthly Basis |

4 | Income Tax | Form No. 16 B | Due date for issue of TDS Certificate for tax deducted under Section 194‐IA in the month of February, 2018 | |

5 | Income Tax | Form No. 16 C | Due date for issue of TDS Certificate for tax deducted under Section 194‐IB in the month of February, 2018 | |

6 | FCRA | ‐‐‐‐‐‐‐‐‐‐‐‐ | Quarterly intimation of FC receipt by associations for the quarter ending 31.03.2018 | |

7 | Provident Fund | Electronic Challan Cum Return (ECR) | E‐payment of PF for March ‐ 2018 | |

8 | Income Tax | Form No. 15CC | Statement by Banks etc. in respect of foreign remittances during the quarter | |

9 | Provident Fund | ‐‐‐‐‐‐‐‐‐‐‐‐ | PF Monthly PF payment for March. 2018 | |

10 | ESIC | ‐‐‐‐‐‐‐‐‐‐‐‐ | ESIC payment for the month of March. 2018 | |

11 | Provident Fund | ‐‐‐‐‐‐‐‐‐‐‐‐ | Provident Fund (includes EDLI) PF Return filing for March 2018 | |

12 | GST | EWB‐01 | E‐way Bill Mandatory for Intra‐state Supplies | |

13 | GST | GSTR ‐ 4 | GSTR 4 for (composite dealers Quarterly Return) January to March ‐ 18 | |

14 | GST | GSTR ‐ 3B | GSTR Return Summary for March ‐ 2018 | |

15 | GST | GSTR ‐ 5 | GSTR‐5 for (Non resident ) March ‐ 2018 | |

16 | GST | GSTR ‐ 5A | GSTR‐5A for (Non‐resident Foreign Taxpayers) March ‐ 2018 | |

17 | ESI | ESI Challan | Payment of ESI for March ‐ 2018 (Applicable for Salary up to Rs. 21,000 instead of 15,000 earlier) | |

18 | Income Tax | Form 61 | E‐filing of information of declarations in Form 60 received up to 31st March ‐ 2018 | |

19 | Income Tax | Challan No. ITNS‐281 | Payment of TDS/TCS deducted/collected in March ‐ 2018 | |

20 | Income Tax | Form No. 15G/H | E‐filing of form 15 G/H for March ‐ 2018 Quarter | |

21 | Company Law | AOC‐4 XBRL | Last date of filing of of AOC‐4 XBRL E‐Forms using Ind AS under the Companies Act, 2013 | |

22 | Company Law | e‐CODS | Last date of submitting documents and filing E‐form under Condonation of Delay Scheme 2018 | |

23 | GST | GSTR ‐ 1 | Taxpayers with annual aggregate turnover up to Rs. 1.5 crore need to file GSTR 1 for January ‐ March on Quarterly Basis | |

24 | Income Tax | Form No. 61 | Due date for e‐filing of a declaration in Form No. 61 containing particulars of Form No. 60 received during the period October 1, 2017 to March 31, 2018. | |

25 | Income Tax | Challan 281 | Due date for deposit of TDS for the period January 2018 to March 2018 when Assessing Officer has permitted quarterly deposit of TDS under section 192,194A, 194D or 194H. | |

26 | Income Tax | Form 24G | Due date for furnishing of Form 24G by an office of the Government where TDS for the month of March 2018 has been paid without the production of a challan | |

27 | Income Tax | Form No. 26QB | Due date for furnishing of challan‐cum‐statement in respect of tax deducted under Section 194‐IA in the month of March 2018 | |

28 | Income Tax | Form No. 26QC | Due date for furnishing of challan‐cum‐statement in respect of tax deducted under Section 194‐IB in the month of March 2018 | |

29 | CODS | Defaulting Companies | Condonation of Delay Scheme 2018 [CODS 2018] allows Defaulting Companies to file its overdue documents which were due for filing. |

Comments

Post a Comment