Liability to pay advance Income tax

Liability to pay advance tax

As per section 208, every person whose estimated tax liability for the year is Rs. 10,000 or more, shall pay his tax in advance, in the form of “advance tax”. In this part you can gain knowledge on various provisions relating to payment of advance tax by a taxpayer.

Person not liable to pay advance tax

As discussed above, every person whose estimated tax liability for the year is Rs. 10,000 or more is liable to pay advance tax.- However, a resident senior citizen (i.e., an individual of the age of 60 years or above during the relevant financial year) not having any income from business or profession is not liable to pay advance tax.

Illustration

Mr. Kumar is running a provision store. The turnover of the store for the financial year 2020-21 amounted to Rs. 1,84,00,000. He wants to declare income under section 44AD at 8% of the turnover. He does not have any other source of income. Will he be liable to pay advance tax?

**

Mr. Kumar satisfies the criteria of section 44AD in respect of provision store business and, hence, he can adopt the provisions of section 44AD and declare income at 8% of the turnover.

A taxpayer opting for the presumptive taxation scheme of section 44AD is also liable to pay advance tax in respect of business covered under section 44AD. Thus, if Mr. Kumar adopts the provisions of section 44AD, he is also liable to pay advance tax in respect of income generated from provision store business.

Illustration

Mr. Vipul (age 39 years) is running a medical store. The turnover of the store for the financial year 2020-2 1 amounted to Rs. 40,00,000. His accounts revealed a net profit of Rs. 2,60,000. Will he be liable to pay advance tax?

**

In this case, Mr. Vipul will be liable to pay advance tax in respect of income generated from medical store business if his estimated tax liability for the financial year comes out Rs. 10,000 or more. The taxable income of Mr. Vipul is Rs. 2,60,000. Tax on Rs. 2,60,000 will be Rs. NIL, hence, Mr. Vipul is not liable to pay advance tax.

(*) The normal tax rates for the financial year 2020-2 1 applicable to an individual below the age of 60 years are as follows:

- Nil upto income of Rs. 2,50,000

- 5% for income above Rs. 2,50,000 but upto Rs. 5,00,000

- 20% for income above Rs. 5,00,000 but upto Rs. 10,00,000

- 30% for income above Rs. 10,00,000.

However in case of taxpayer, being an Individual resident in India, rebate under section 87A of Rs. 12,500 or 100% of tax, whichever is lower, would be provided if his total income does not exceed Rs. 5,00,000.

Apart from above, health and education cess @ 4% will be levied on the amount of tax.

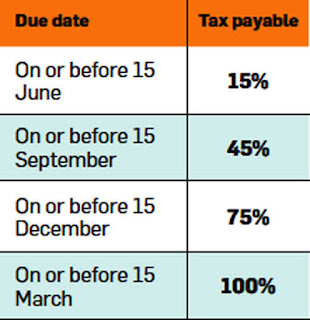

Due dates for payment of advance tax

Advance tax is to be paid in different instalments. The due dates for payment of different instalments of advance tax are as follows:

|

Status |

By 15th June |

By 15th Sept. |

By 15th Dec. |

By 15th March |

|

All assessees (other than the eligible assessee as referred to in Section 44AD or section 44ADA) |

Minimum 15% of advance tax |

Minimum 45% of advance tax |

Minimum 75% of advance tax |

Minimum 100% of advance tax |

|

Taxpayers who opted for presumptive taxation scheme of section 44AD or section 44ADA |

Nil |

Nil |

Nil |

Minimum 100% of Advance tax |

Note 1: Any tax paid till 31st March will be treated as advance tax.

Note 2: If the last day for payment of any instalment of advance tax is a day on which the banks are closed, then the taxpayer should pay the advance tax on the immediately following working day [Circular No. 676, dated 14-1-1994].

Illustration

Mr. Kumar is a doctor. Although MR. Kumar is in profession specified under Section 44AA(1) but he doesn’t opt for the presumptive taxation scheme of Section 44ADA. His estimated tax liability for the financial year 2020-21 amounted to Rs. 1,00,000. By which dates he should pay advance tax and how much?

**

If the estimated tax liability of the taxpayer is Rs. 10,000 or more, then he has to discharge his tax liability in the form of advance tax. Advance tax is to be paid in different instalments. The due dates for payment of different instalments of advance tax are as follows:

|

Status |

By 15th June |

By 15th Sept. |

By 15th Dec. |

By 15th March |

|

All assessees (other than the eligible assessee as referred to in Section 44AD or section 44ADA) |

Minimum 15% of advance tax |

Minimum 45% of advance tax |

Minimum 75% of advance tax |

Minimum 100% of advance tax |

|

Taxpayers who opted for presumptive taxation scheme of section 44AD or section 44ADA |

Nil |

Nil |

Nil |

Minimum 100% of Advance tax |

- Kumar being a doctor is in profession specified under section 44AA(1) but he doesn’t opt for the presumptive taxation scheme of section 44ADA. Hence, he has to pay advance tax in four installments as given hereunder:

- His first installment of advance tax will fall due on 15th June, 2020. He should pay 15% of his tax liability in advance, hence, he should pay Rs. 15,000 on account of advance tax by 15th June, 2020.

- His second installment of advance tax will fall due on 15th September, 2020. By 15th September, he should pay 45% of his liability in advance, i.e., Rs. 45,000. Assuming that he has already paid Rs. 15,000 as advance tax by 15th June, he should pay balance of Rs. 30,000 on account of advance tax by 15th September, 2020. Thus, total payment of advance tax till 15th September will amount to Rs. 45,000.

- His third installment of advance tax will fall due on 15th December, 2020. By 15th December, he should pay 75% of his liability in advance, i.e., Rs. 75,000. Assuming that he has already paid Rs. 45,000 as advance tax till 15th September, he should pay balance of Rs. 30,000 on account of advance tax by 15th December, 2020. Thus, total payment of advance tax till 15th December, 2020 will amount to Rs. 75,000.

- His fourth and final installment of advance tax will fall due on 15th March, 2021. By 15th March, he should pay 100% of his liability in advance, i.e., Rs. 1,00,000. Assuming that he has already paid Rs. 75,000 as advance tax till 15th December, he should pay balance of Rs. 25,000 on account of advance tax by 15th March, 2021 Thus, total payment of advance tax till 15th March, 2021 will amount to Rs. 1,00,000.

- Mode of payment of advance tax

- As per Rule 125 of the Income-tax Rules, 1962 a corporate taxpayer (i.e., a company) shall pay taxes through the electronic payment mode using the internet banking facility of the authorised banks.

- Taxpayers other than a company, who are required to get their accounts audited, shall pay taxes through the electronic payment mode using the internet banking facility of the authorised banks.

- Any other taxpayer can pay tax either by electronic mode or by physical mode i.e. by depositing the challan at the receiving bank.

- Payment of advance tax

- Advance tax can be paid by the taxpayer either on his own account or in pursuance of an order of the Assessing Officer.

- The taxpayer who is liable to pay advance tax is required to estimate his current income and pay advance tax on his own account. In such a case, he is not required to submit any estimate or statement of income to the tax authorities.

- After making payment of first or second or third instalment of advance tax (as the case may be), if there is a change in the tax liability, then the taxpayer can revise the quantum of advance tax in the remaining instalment(s) and pay the tax as per revised estimates.

- Tax can be computed on the current income (estimated by the taxpayer) at the rates in force during the financial year. From the tax so computed, tax deducted or collected at source will be deducted and the balance tax payable will be used to compute the advance tax liability. Also, relief of tax allowed under section 90 or section 90A or any deduction under section 91 or any tax credit allowed to be set off as per section 11 5JAA or section 1 15JD shall also be deducted while computing the advance tax liability.

- Illustration

- Raja is an architect. Although MR. Rana is in profession specified under Section 44AA(1) but he doesn’t opt for the presumptive taxation scheme of Section 44ADA. His estimated tax liability for the year amounts to Rs. 1,00,000. He has paid advance tax of Rs. 15,000 by 15th June. In the month of August one of his clients paid fee of Rs. 1,80,000 after deducting tax at source of Rs. 20,000 (Such fees of Rs. 1,80,000 was considered at earlier occasion for estimating the tax liability of taxpayer). In this case how much of advance tax he is required to pay in the remaining installments?

- **

- If the estimated tax liability of the taxpayer is Rs. 10,000 or more, then he has to discharge his tax liability in the form of advance tax. Advance tax is to be paid in different installments. The due dates for payment of different installments of advance tax in case of all assessees (other than the eligible assessees as referred to in section 44AD or section 44ADA) are as follows:

|

By 15th June |

By 15th Sept. |

By 15 Dec. |

By 15th March |

|

15% |

45% |

75% |

100% |

Considering the above dates, Mr. Raja has to pay 15% of his estimated tax liability by 15th June. Hence, he has to pay Rs. 15,000 on account of advance tax by 15th June. While computing the advance tax liability, the taxpayer can deduct the tax at source from his income. In this case, at the time of estimation of first installment there was no TDS credit with Mr. Raja. His estimated tax liability without TDS amounted to Rs. 1,00,000. In the month of August he received Rs. 1,80,000 after deduction of tax of Rs. 20,000, hence, he got a TDS credit of Rs. 20,000. His tax liability after granting of credit of TDS will come to Rs. 80,000. In second installment, i.e., by 15th September he should pay up to 45% of his revised tax liability. Thus, he should pay up to Rs. 36,000 (i.e., 45% of Rs. 80,000) by 15th September. He has already paid Rs. 15,000 by 15th June and, hence, he should pay balance of Rs. 21,000 by 15th September. In third installment, i.e., by 15th December he should pay 75% of his estimated tax liability. Thus, he should pay Rs. 60,000 (i.e., 75% of 80,000) by 15th December. He has already paid Rs. 36,000 till 15th September and, hence, he should pay balance of Rs. 24,000 by 15th December (i.e., Rs. 60,000 – Rs. 36,000).Finally in fourth and final installment, i.e., by 15th march he should pay 100% of his estimated tax liability. Thus he should pay Rs. 80000 by 15thMarch. He has already paid Rs. 60000 till 15th December and hence, he should pay Rs. 20000 by 15th March (i.e., Rs.80000-Rs.60000).

Illustration

Mr. Rana is an engineer. Although MR. Rana is in profession specified under Section 44AA(1) but he doesn’t opt for the presumptive taxation scheme of Section 44ADA. His estimated tax liability for the year amounts to Rs. 2,00,000. He has paid advance tax of Rs. 30,000 by 15th June. In the month of August he got a contract from a multinational company. After incorporating the receipts of the new contract, his revised tax liability for the year amounts to Rs. 3,00,000. In this case, how much advance tax he is required to pay in each installment?

**

If the estimated tax liability of the taxpayer is Rs. 10,000 or more, then he has to discharge his tax liability in the form of advance tax. Advance tax is to be paid in different installments. The due dates for payment of different installments of advance tax in case of all assessees (other than the eligible assessees as referred to in section 44AD or section 44ADA) are as follows:

|

By 15th June |

By 15th Sept. |

By 15 Dec. |

By 15th March |

|

15% |

45% |

75% |

100% |

Considering the above dates, Mr. Rana has to pay 15% of his estimated tax liability by 15th June. Hence, he has to pay Rs. 30,000 on account of advance tax by 15th June (in June he was not aware of the contract and, hence, Rs. 30,000 will be payable in first installment of advance tax liability).

After making payment of first/second installment of advance tax, if there is a change in the tax liability, the taxpayer can revise the quantum of advance tax in the remaining installment(s) and pay the tax as per revised estimate.

In this case, after payment of first installment, he got the contract from the multinational company and his revised estimated tax liability came to Rs. 3,00,000, hence, he has to pay advance tax considering the revised liability of Rs. 3,00,000.

In second installment, i.e., by 15th September, he should pay up to 45% of his revised liability. Thus, he should pay up to Rs. 1,35,000 (i.e., 45% of Rs. 3,00,000) by 15th September. He has already paid Rs. 30,000 by 15th June and, hence, he should pay balance of Rs. 1,05,000 by 15th September.

In third installment, i.e., by 15th December he should pay 75% of his estimated tax liability. Thus, he should pay up to Rs. 2,25,000(i.e., 75% of 3,00,000) by 15th December. He has already paid Rs. 1,35,000 till 15th September and, hence, he should pay balance of Rs. 90,000 by 15th December (i.e., Rs. 2,25,000 – Rs. 1,35,000).

In Fourth and final installment, i.e., by 15th March he should pay 100% of his estimated tax liability. Thus, he should pay up to Rs. 3,00,000 by 15th March. He has already paid Rs. 2,25,000 till 15th December and, hence, he should pay balance of Rs. 75,000 by 15th March (i.e., Rs. 3,00,000 – Rs. 2,25,000).

Payment of advance tax in pursuance of an order of the Assessing Officer

If taxpayer fails to pay advance tax (or advance tax paid is lower than the required amount) and he has already been assessed by way of regular assessment in respect of the total income of any previous year, then the Assessing Officer may pass an order under section 2 10(3) requiring him to pay advance tax on his current year’s income (specifying the amount of instalments in which tax should be paid). Such an order may be passed during the financial year, but not later than the last day of February.

On receipt of the notice from the Assessing Officer to pay advance tax, if the taxpayer’s estimate is lower than the estimate of the Assessing Officer, then the taxpayer can submit his own estimate of current income/advance tax and pay tax accordingly. In such a case, he has to send intimation in Form No. 28A to the Assessing Officer.

Alternatively, if the advance tax on current income as per own estimate of the taxpayer is likely to be higher than the amount estimated by the Assessing Officer, the taxpayer shall pay such higher amount as advance tax in accordance with his own calculation. In such a case, no intimation to the Assessing Officer is required.

The Assessing Officer can revise his order issued to the taxpayer to pay advance tax (as discussed above) under section 210(4). Such revision can be done, if subsequent to the passing of an order to pay advance tax but before 1st March of the relevant financial year a return of income in respect of any later year has been furnished by the taxpayer or any assessment for any later year has been completed at a higher figure. On receipt of such order, the procedure to be followed by the taxpayer will be same as discussed earlier.

Compute the amount of advance tax to be paid by Mr. Kapoor (age 35 years) from the following details provided by him (for the year 2020-2 1):

- Taxable business income Rs. 10,84,000.

- Interest on debenture Rs. 9,000 (after deduction of tax at source of Rs. 1,000).

- Investment in NSC during the year Rs. 80,000.

- He has paid tuition fees of his son of Rs. 1333.

**

Computation of taxable income and tax liability of Mr. Kapoor for the year 2020-21 :

|

Particulars |

Rs. |

|

Profits and gains of business or profession Taxable business income |

10,84,000 |

|

Income from other source Debenture interest (Rs. 9,000 net interest + TDS of Rs. 1,000) |

10,000 |

|

Gross total income |

10,94,000 |

|

Less: Deduction under section 80C (NSC and tuition fees) |

81,333 |

|

Total Income (i.e. Taxable Income) |

10,12,667 |

|

Tax on Rs. 10,12,667 (*) |

1,16,300 |

|

Less: Rebate under section 87A (lower of 100% of tax or Rs. 12,500) |

Nil |

|

Tax liability after rebate under section 87A |

1,16,300 |

|

Add: Health and Education cess @ 4% |

4,652 |

|

Tax liability before TDS |

1,20, 952 |

|

Less: Tax deducted at source |

1,000 |

|

Tax liability after TDS |

1,19,952 |

(*) The normal tax rates for the financial year 2020-2 1 applicable to an individual below the age of 60 years are as follows:

- Nil up to income of Rs. 2,50,000

- % for income above Rs. 2,50,000 but up to Rs. 5,00,000

- 20% for income above Rs. 5,00,000 but up to Rs. 10,00,000

- 30% for income above Rs. 10,00,000.

Apart from above, health and education cess at 4% will be levied on the amount of tax.

As per section 208, every person whose estimated tax liability for the year is Rs. 10,000 or more, shall pay his tax in advance, in the form of “advance tax”. In this case, the tax liability amounts to Rs. 1,19,952 and, hence, Mr. Kapoor is liable to pay advance tax.

The due dates for payment of different installments of advance tax in case of all assessees (other than the eligible assessees as referred to in Section 44AD)are as follows:

|

By 15th June |

By 15th Sept. |

By 15 Dec. |

By 15th March |

|

15% |

45% |

75% |

100% |

Considering the above due dates, the advance tax to be paid by Mr. Kapoor on different dates will be as follows:

His first installment of advance tax will fall due on 15th June, 2020. His estimated tax liability for the year is Rs. 1,19,952 (for easy computation, liability is rounded off to Rs. 1,19,950). By 15th June, he should pay 15% of his liability in advance, hence, he should pay Rs. 17,993 on account of advance tax by 15th June, 2020.

His second installment of advance tax will fall due on 15th September, 2020. His estimated tax liability for the year is Rs. 1,19,952 which is rounded off to Rs. 1,19,950. By 15th September he should pay 45% of his tax liability in advance, i.e., Rs. 53,978. Assuming that he has already paid Rs. 17,993 as advance tax by 15th June, he should pay balance of Rs. 35,985 on account of advance tax by 15th September, 2020. Thus, total payment of advance tax till 15th September will amount to Rs. 53,978.

His third installment of advance tax will fall due on 15th December, 2020. His estimated tax liability for the year is Rs. 1,19,952 which is rounded off to Rs. 1,19,950. By 15th December, he should pay 75% of his liability in advance, i.e., Rs. 89,963. Assuming that he has already paid Rs. 53,978 as advance tax by 15th September, he should pay balance of Rs. 35,985 on account of advance tax by 15th December, 2020. Thus, total payment of advance tax till 15th December will amount to Rs. 89,963.

His fourth and final installment of advance tax will fall due on 15th March, 2021. His estimated tax liability for the year is Rs. 1,19,952 which is rounded off to Rs. 1,19,950. By 15th March, he should pay 100% of his liability in advance, i.e., Rs. 1,19,950. Assuming that he has already paid Rs. 89,963 as advance tax by 15th December, he should pay balance of Rs. 29,988 on account of advance tax by 15th March, 2021. Thus, total payment of advance tax till 15th March will amount to Rs. 1,19,950.

Note: The CBDT vide the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020, dated 3 1-03-2020, has extended all respective due dates, falling during the period from 20-03-2020 to 29-06-2020, till June 30, 2020.

The benefit of extended due date shall not be available in respect of payment of tax. However, any delay in payment of tax which is due for payment from 20-03-2020 to 29- 06-2020 shall attract interest at the lower rate of 0.75% for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

Source- Income Tax Act, Rules and http://www.incometaxindia.gov.in/

You have provided a richly informative article. It is a beneficial article for me.Thanks for sharing this information here. Canada Tax Deadline

ReplyDeleteExcellent post. I really enjoy reading and also appreciate your work.property tax advisors for residential property in boston UK This concept is a good way to enhance knowledge. Keep sharing this kind of articles, Thank you.

ReplyDeleteYou have provided valuable data for us. It is great and informative for everyone.Read more info about accountants tax returns Keep posting always. I am very thankful to you.

ReplyDeleteGreat job for publishing such a nice article. Your article isn’t only useful but it is additionally really informative. Read more info about Corporation Tax Services In London. Thank you because you have been willing to share information with us.

ReplyDeleteExcellent knowledge, You are providing important knowledge. It is really helpful and factual information for us and everyone to increase knowledge. Continue sharing your data. Thank you. Read more info about Professional Tax Advisors In London

ReplyDeleteI really appreciate your work which you have shared here about the The article you have shared here is very informative and the points you have mentioned are very helpful. Thank you so much.singapore accountants

ReplyDeleteTaxpayers' stress levels are lower thanks to advance tax. Taxpayers can avoid financial stress and last-minute tax payments by paying their taxes in advance. The procedure of collecting taxes is sped up. As a result of being able to generate interest on the money collected, it enhances government funding. People who pay their taxes in advance avoid missing payments. It gives firms a better understanding of their annual income and aids in sound financial management.

ReplyDeletetax accounting

You have shared such a great post about Income tax. I got some valuable information from this post. Thanks for sharing such type of post. Keep Post. stock charting tool.

ReplyDelete